#Airbnbust - Can You Still Make Money in Short-term Rentals?

#Airbnbust News Driven by Oversupply

Is it possible to find, list and profit from short-term rentals (STRs) in America anymore? There has been much doom and gloom written about the declining fortunes of short-term rental owners, starting in Fall of 2022, when a twitter user coined the phrase #Airbnbust. Major business news outlets like the Wall Street Journal, Bloomberg, TIME, Business Insider, and popular online forums like Twitter, Reddit, and BiggerPockets have all reported on the downward trend experienced by STR owners. Even the 2023 kingpin of sporting events, Super Bowl LVII in Glendale, AZ, property managers in Phoenix noted substantial vacancy, and large price discounts.

Each article references a sampling of STR owner data to draw the conclusion that rampant oversupply of units is the main culprit behind Airbnbust.

Looking at the population of data, the cause of the supposed “bust” is not due to a declining demand in number of travelers, or guests flocking back to hotels. In fact 2022 was a record year of STR demand (e.g., Airbnb posted record-breaking revenues and its first ever year of profitability). It appears that demand was slightly outstripped by supply, including expanded availability for booking dates on listed STR locations. AirDNA estimates that both demand and supply increased by 21% in 2022.

The fact that both demand and supply have increased so rapidly is welcome news to the sophisticated STR real estate investor, as there is more data available to understand what top performing investments look like.

Heightened STR Supply Churn

The phenomenon of STR industry churn is not new. It is the natural effect of some STRs exiting the market when properties become less competitive, or when certain destinations decline in popularity (e.g., locations that were temporarily popular during COVID). However, the data show that the pace and extent of new growth and weeding out of old supply was heightened in 2022 as compared to prior years. An AirDNA analysis looking at Airbnb’s global active listings shows this trend starkly in a chart (below) where a whopping 54%+ of Airbnb listings have been added since 2020.

What are You Measuring Against? Know Your Baseline

If comparing YoY occupancy and rates, 2021 was a banner year as was the start of 2022. This was a time when travelers came out of lockdowns and much of the workforce was still friendly to remote or work from home jobs. Today, occupancy and rates are returning back to levels typically seen in 2019, yet still above pre-pandemic times.

Supply Increases will Continue in a Recession

In a weakening economy with recession signs flashing, there is an expectation of an increased imbalance in supply and demand, where guests and businesses trim back on travel and more owners seek to rent out properties as STRs to meet mortgage payments and find extra pockets of income. And STRs are no secret, with Airbnb, VRBO, and others trumpeting advertisements across TV and online channels as the top spending groups in travel.

Acquire with Conviction

The industry is still in the early innings of growth and maturation, and for the sophisticated investor, a growing supply base represents an opportunity to better understand where the best opportunities are to acquire high performing assets.

Investors should consider several components for success with STR investments to beat the competition:

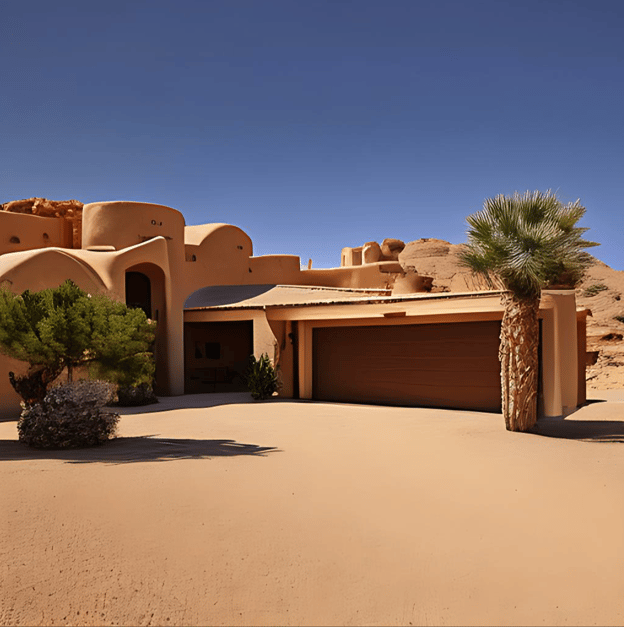

1.Location: investments in STRs are like any other part of the real estate world, where the top 3 most important rules in investing are: “location, location, location.” Where an asset is located in relation to local attractions, the immediate neighborhood status and trajectory, and typical socio-economic indicators for the region (e.g., inward migration, job prospects, employer growth) are all important. Indeed, we have seen that guest willingness to pay is different, even amongst properties in the same (large) resort due to location distance.

2. Regulation: a recent discussion with a notable longtime STR property manager noted their top criteria for investments: “location, location, regulation, location.” For many investors, the single most important binary judgment call on an investment property is whether an asset has a favorable regulatory jurisdiction. And Andes STR, we prefer neighborhoods where regulation is already codified and settled, and where non-trivial tax contributions from the STR industry already exist.

3. Differentiation: beyond location, it is important for assets to possess unique features. For some, that means a mural or artistic features that create an “Instagrammable” moment. In others it includes the installation of providing unique features and functions (e.g., a night-time fishing light off the dock). A property manager we interviewed who operates nearly 100 properties in major Texas cities noted that she did not experience much of an issue at all in 2022, though her properties were in locations profiled in the WSJ article on Airbnbust. She attributed her success to managing larger, unique properties in the most vibrant neighborhoods in the city.

4. Amenities: one way to provide differentiation is through the on-site amenities a property has. But it is not just a matter of adding amenities – investors should prioritize amenities that are most desirable, and work to understand the payback period or revenue lift from adding items (e.g., the payback period for a jacuzzi, pool, or a sauna).

5. Demand drivers analysis: investors often select a city to acquire assets in, assuming a homogenous pool of guests, or without regard for understanding the visitor decomposition. A prudent investor will not only know what demand streams typically visit STRs, but will also determine a hierarchy of price elasticities.

6. Durability of demand: analyzing the demand drivers today is only good for that unique snapshot in time. An investor must consider how persistent and durable such a source of demand is. For instance, how would demand change during a recession or travel shock (e.g., COVID)? What is good now… may not last

7. Property manager selection: and lastly, profitable STR investments rely on property manager selection as a feature of the investment, rather than a commodity. An exceptional property manager directly drives significant cash flow during the life of the hold. A best-in-class operator will limit the total cost to operate (e.g., minimize expenses for asset utilization; perform preventative maintenance to avoid major issues and retain pristine condition when looking to sell). There is a massive opportunity to be best-in-class and to raise the standards for all property manager industry participants.

8. Downside risk protection: Finally, an understanding of an investment’s downside protection is important. This includes the ability to convert into a long-term rental option, or if the market is highly liquid (the ability to sell off in liquid market).

Closing Remarks

Whether it is your first investment property, or your 50th investment in a portfolio, Andes STR can help you in your STR investing journey. Our flagship market in the US is in a classically “oversupplied” market, where we have been able to deliver strong cash flow and returns for investors. Our investment thesis driven process, coupled with our data-driven approach and award-winning machine learning technology allow us to swiftly partner with institutions to accurately underwrite, and subsequently manage, high performing STR properties.