Outsmart a runaway recession train with short-term rental investments (Part 1)

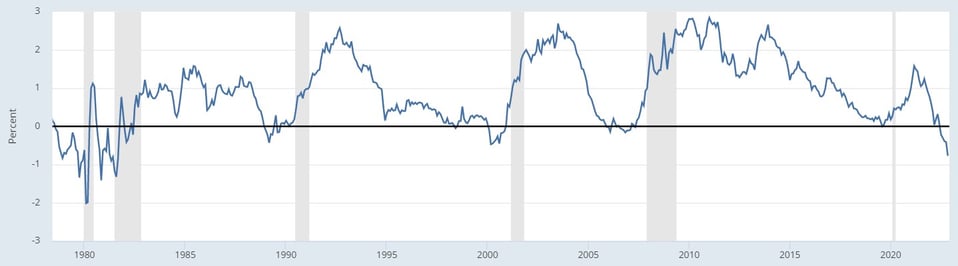

Most economists are predicting a recession to hit the U.S. economy within the next year. For instance, both the WSJ economist survey and Pitchbook quantitative forecast estimate a recession with 65% likelihood. Technical indicators are also flashing red, with the largest yield curve inversion in 40 years, which has preceded every recession for the past half century.

Inverted Yield Curve: 10-Year Treasury Minus 2-Year Treasury Yields

Source: Federal Reserve Bank of St. Louis

Recession impact on hospitality sector lags other sectors

Studies and industry experts note that the hospitality and lodging industry generally see a lagged effect on hospitality revenues vs. other parts of the economy.

In a recent Boston University Hospitality Review study, John O’Neill, Professor of Hospitality Management, noted that Gross Private Domestic Investment (GPDI) is the economic indicator with the greatest predictive power on hospitality industry revenues. GPDI is one of the four components of GDP, and typically referred to simply as “Investments.” Capital investments by U.S. firms are particularly sensitive to changes in interest rates, which are inversely correlated: as the Fed raises interest rates, businesses and households invest less, and future productive capacity and economic prospects are reduced. While not every pattern of declining GPDI has portended a recession, the last three recessions were preceded by a decline in GPDI, and GPDI has declined concurrently in all of the last eight. To put things in context, the prior two quarters have experienced GPDI declines, as the Fed has increased interest rates in response to high inflation (note: STRs are a preferred investment during inflationary times), which could indicate a coming downturn for the hospitality sector.

In a study performed by AirDNA, they broke down the business cycle of the general hospitality industry. In an infographic (below), they describe how at the start of a downturn occupancy levels first decline, followed by pricing, and that an eventual recovery lags other sectors of the economy.

The Lodging Industry Business Cycle

.png?width=1137&height=489&name=image%20(11).png) Source: VRM Intel, AirDNA, CBRE

Source: VRM Intel, AirDNA, CBRE

Short-term rental recession effects

Besides the early days of COVID-19, the short-term rental (STR) market, which entered its mass market growth phase after 2014, has never gone through a lengthy recession before. Because it is a relatively new asset class, there are many who wonder what effect an economic downturn will have on the STR market.

For STR owners and investors, it is important to consider the different forces at play in recessions, and the ways to guard against them. Each recession has the potential to impact travel and consumer demand, investor and owner supply, and underlying property price appreciation. We review the demand effects here, and will explore supply side effects in a later note.

Historical demand effects

The demand effects of a recession on willingness of tourists and businesses to travel are complex and continue to be studied.

After the dot-com bubble burst and subsequent events of 9/11, US nationwide tourism revenues suffered losses of over -20%, and took roughly 4 years to resume pre-recession levels. Similarly, following the 2008 great financial crisis, tourism industry revenues lost -20%, though the recovery was quicker. After the 2020 pandemic-induced recession, industry-wide tourism revenues have not fully returned to pre-pandemic levels.

Though recessions have resulted in a reduction in tourism revenues, a deeper look reveals differences behind each downturn. In 2001 and 2002, hotel revenues held up whereas airline revenues cratered following the 9/11 terrorist attacks. In 2008-09, a -4% decline in the hotel industry revenues affected geographies in different ways; for instance, Florida tourism experienced a far less severe outcome vs. the rest of the US. And after 2008, while airline revenues declined, the rise of the “staycation” occurred, with families and groups electing to travel locally, or to less exotic, drivable destinations. For example, visits to US National Parks increased +4% in 2009 reversed a previous trend of half a decade in stagnant and declining National Park tourists.

Further, over the past 2 decades, the rise of virtual conference technology used in lieu of in-person business meetings accelerated after the COVID-19 induced recession. Breaking down the pre- and post-2020 hospitality spend further, we see STRs have bounced back to growth mode more rapidly compared to hotels. Indeed short-term rental revenues after the pandemic have continued to outpace overall pre-pandemic revenues. The rationale for STRs outpacing hotels are numerous, including health and hygiene factors (proximity to guests or shared ventilation, as we wrote in an earlier note), decline in business stays (where hotels’ have a high mix of business-related stays vs. STRs), and, in some cases, a more cost-effective alternative to hotels. In late 2022, these forces continue to persist, with hotels still off from historic highs in 2019.

Preparing for a near-term recession

In August 2022, when asked about a potential future recession, Brian Chesky, CEO of Airbnb, said that “even as we are entering a recession, people have been… isolated for years, and they are yearning to get out… the one thing you are going to see them spend money on, is they are going to continue to travel.”

Prior recessions give us a hint that future recession will impact the tourism market at large, but also that certain locations, asset types and use cases will outperform. This is why it is important to partner with a service like Andes STR, which helps investors find locations with resilience to recession risks, optimizing for asset types and use cases where guests are more predictable and less price elastic.

The investors who will be best positioned to weather a downturn will be those whose properties are unique, are in drivable areas where staycationers travel to, and that cater to a more price inelastic group (e.g., cater to entertainment for groups, and all ages). The continued rise of digital nomads and marketing properties to over 30-day medium-term rentals is another way for investors to take advantage of a population who will likely grow as traditional employers shed jobs and employees find remote jobs or decide to be self-employed.

Stay tuned for supply effects…

Stay tuned for next month’s note, where we will look at the supply-side, including STR inventory, and real estate price appreciation prospects during a recession.