Outsmart a runaway recession train (part 2): will property prices devalue? And how to combat oversupply

Markets, economists and business leaders point to a looming recession in the near-term. A recent Conference Board survey of CEOs found that 98% of CEOs expect a recession in the next 12-18 months (up from 95% earlier this year).

In our November 2022 report we discussed how a recession has a lagged effect on the hospitality sector, and how to watch and prepare for certain demand-side effects (i.e., travelers and guests). In this report we explore supply-side effects for short-term rental (STR) investors, namely: (1) the risk of an oversupply of inventory of STR listings and (2) the risk of property price devaluation.

Risk of Property Price Devaluation — Prices went Up in 4 of the Last 6 Recessions

The GFC and its recession was uniquely tied to real estate, where a bubble in the US housing market grew due to loose underwriting standards. After the real estate bubble popped in 2008, home values declined across the US. Many people today still believe that recessions are strongly correlated with declining home values. This, in fact, is not true. Looking back at the past 6 recessions, only two of the last six recessions ended with eroded home values.

Chart: Home Price Changes During the Last Six Recessions

1980 - 2022 US Recessions

Source: CoreLogic

In the decade after the GFC two important changes occurred which have created a very different housing scenario for a potential recession: (1) US inventory of housing stock is down (more than 50% by some measures), and (2) tighter mortgage underwriting standards set after the GFC remain in place today. Furthermore, it is unlikely that we will see home prices crash in a potential recession due to the record low inventory of single family home inventory and multi-decades low rental vacancy rates.

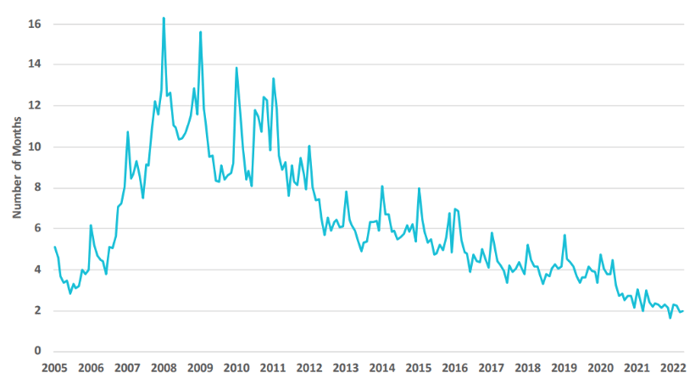

Chart: U.S. Existing Single Family Months of Inventory Remaining

2005-22

Source: Black Knight

Chart: Rental Vacancy Rate in the U.S.

1980 - 2022

Source: US Census Bureau; Federal Reserve Bank of St. Louis

Though recessions may not cause a decrease in home values for the nationwide average, individual geographies can be adversely affected. This is especially important for STR property owners to pay attention to, as some travel destinations experience an unwelcome shock to traveler elasticity during a recession. As the industry trade journal Hotel Tech Report noted: “tough economic times can push travel into the ‘luxury’ category, thus increasing the price elasticity.” For STR owners worried about such a shift, an important tool in the toolbelt is a team of educated property management professionals who know how to adjust for the differences in economic cycles, which automatic revenue management software will not anticipate. At Andes STR we provide such insight for our property management clients, and have observed a wide spectrum in the market from complete reliance on software to managers who perform sporadic manual efforts to adjust rental rates.

If an investor gets caught holding assets in a falling price downdraft, the best option is typically to hold and wait for better conditions. In most markets, prices follow a volume cycle: when sales volume increases, prices tend to increase, and vice versa. Sales volume typically increases due to local phenomenon with new employers, new attractions, or secular migration patterns.

For investors on the sideline, one of the most attractive buying opportunities occurs when locations with positive volume factors (e.g., increasing new job listings, CapEx) also shows rapidly declining property sales volume. This is a signal for potential price dislocation, and to prepare to deploy capital. At Andes we look for these factors when entering new markets, alongside other important STR indicators, such as STR regulatory environment, travel interest, STR supply, cap rates, labor availability, and more.

Beware of Rising Inventory and Oversupply

Before Airbnb was born in 2008, the STR industry had been around for decades. Airbnb was born during the Great Financial Crisis (GFC) of 2008-09 with its ensuing recession, where the founders created a platform where struggling property owners could help pay for their mortgages through short-term rentals. In a recent interview, Brian Chesky, CEO of Airbnb, said that he thinks another recession will lead people to look for new ways of earning money, resulting in many new additions to Airbnb as people rent out their properties.

All else equal, an increase in supply without a comparable increase in demand will intensify competition, driving down revenues. This highlights the importance of selecting an STR investment location where demand reacts favorably to a recessionary economic climate to avoid oversupply and price erosion. Such locations include drivable “staycation” -friendly places, areas with robust economic drivers, or reliance on non-cyclical forces (e.g., medicine, government, etc.).

Beyond location selection, asset-level characteristics and adjustments can also be taken into account. Investors can acquire properties and position amenities and marketing to focus on serving the most price inelastic demand source of travelers (e.g., large groups / families, staycationers, traveling workforce housing) in places with demand and limited alternatives. Sophisticated property managers can add significant value during recessions with data-driven recommendations on small updates to the property, popular amenities, high quality photos, and other updates in aggregate add up to a stronger ROI, and marked differences in design, decor and marketing than owner-occupied and second home listings. Best-in-class property managers also have low-cost and savings programs, such as using multiple high-quality vendors, volume discounts, low-expense ways to manage for good reviews, and returns to scale on logistics costs (e.g., cleaning fees). Finally, property managers can add value through a playbook for increasing rents and ancillary sales (e.g., concierge services).

At Andes STR we use sophisticated machine learning to recommend the most profitable assets in a market, deep data analysis of amenity revenue drivers, and data-driven decision making for property management.